A summary of the measures to alleviate the effects of the COVID-19 pandemic for entrepreneurs

11 May 2020

Summary alleviating measures COVID-19 pandemic for entrepreneurs

In the last few weeks, the Government of Aruba has published various measures to alleviate the effects of the COVID-19 pandemic for entrepreneurs. Because it may be difficult to determine which measure may be applicable in your situation, since some seem to be exclusive of another, BDO has prepared this summary for you based on our understanding of the information available.

Most important measures implemented

The five most important measures to alleviate the effects of COVID-19 pandemic on your cash flow are mentioned below and the other measures included in “Plan di Alivio” will not be discussed but may, depending on your situation, also be applicable.

“Plan di Alivio” (published March 28, 2020)

Point 1:

- Entrepreneurs that:

- Perform activities relating to tourism, casino, transport- & tour operators, security, café/bar/restaurants, landscaping, spa & beauty parlors, car rental, travel agents, watersports, carwash, laundry, perfumeries, jewelers, retail of clothing and shoes, souvenirs, ground handlers, employment agencies and construction companies;

- and generate a Gross Revenue of less than AWG 1 million per month, can apply for a deferral of payment for the monthly taxes (amongst others turnover taxes, tourist levy, and environmental levy but not wage tax and social security premiums) for the tax periods April, May and June, 2020. These entrepreneurs will:

- Need to file a request at the Tax Authorities;

- Demonstrate that there are cash flow issues via simple reporting requirements (not published);

- Keep filing the respective returns in a timely manner; and

- The period of deferral is of maximum 6 months after the restart of the activities.

Point 2:

- The same group of entrepreneurs mentioned above, but with no revenue condition, will enjoy a tax cut of the employers’ portion of AOV/AWW premiums (not for AZV), provided that upon filing of the payroll tax returns for April, May and June 2020, the employee monthly overview (payroll summary) is attached. The AZV is not included!

Point 5:

- No penalties or interest will be charged on additional assessments levied covering the months of April, May and June 2020 due to late or short payment, it is not sure how this works in relation to the wage subsidy.

Point 7:

- A flexible payment arrangement for all taxes and other liabilities will be provided to:

- Individuals: for 24 months with minimum of AWG 100 per month;

- Entrepreneurs: for 24 months with a minimum of AWG 500 per month;

- Pensioners: for 36 months with a minimum of AWG 75 per month.

Wage Subsidy Plan (applicable as of May 2020)

- Upon a decrease in turnover exceeding 25% in the month X compared to the same month of the prior year, and provided all conditions are met, the employer is entitled to a wage subsidy up to 60% of the SVb wages registered at SVb per March 15, 2020 up to a maximum gross SVb salary of AWG 5,850 per month, as well as 11.6% of the AOV/AWW and AZV premiums. It is important to note that the deadline to apply for the wage subsidy for May ends tomorrow, May 12, 2020!

What applies in your situation?

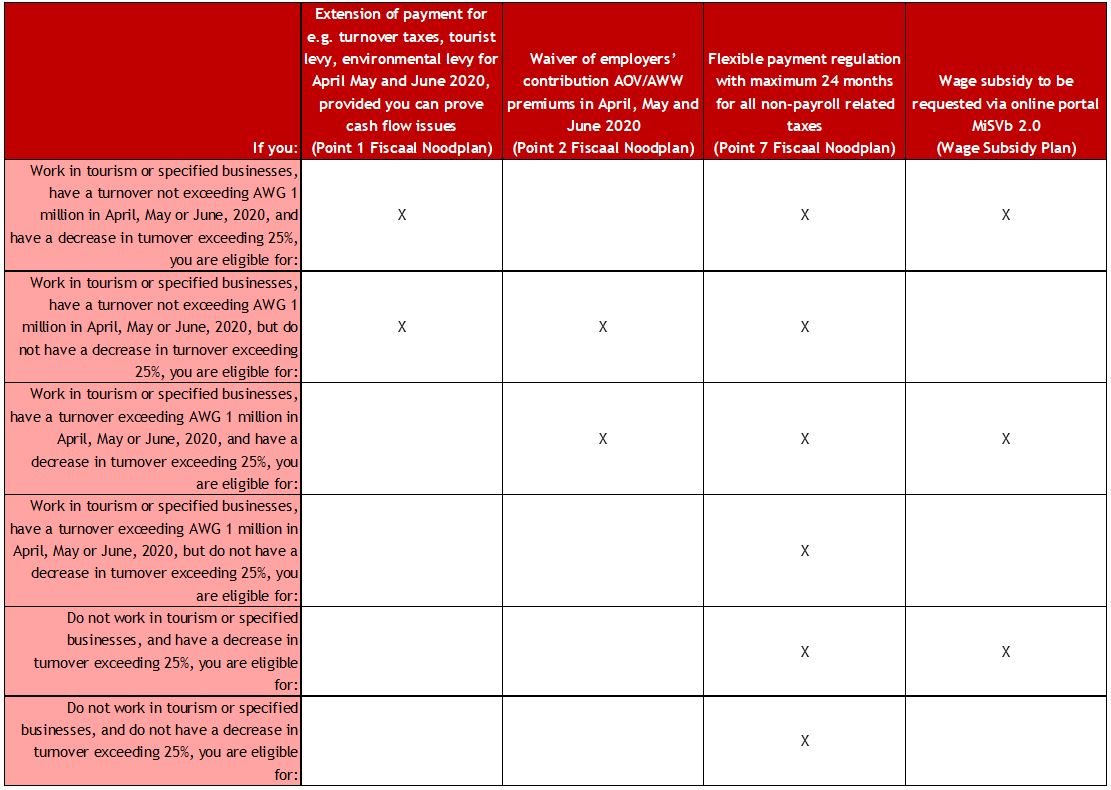

We have summarized the measures that may be applicable in various situations, which we have included in the table below:

How can BDO assist?

Our team of financial, accounting and tax professionals are ready to assist you. You can reach our team via telephone (transferred to the mobiles of the team who will be working from home) or via e-mail:

| cari.wolter@bdoaruba.com |

+297 5286330 |

| statia.charitza@bdoaruba.com |

+297 5286335 |

| kock.christine@bdoaruba.com |

+297 5286339 |

| snijders.frank@bdoaruba.com |

+297 5286331 |

| martis.anushka@bdoaruba.com |

+297 5286334 |

| kock.jakemar@bdoaruba.com |

+297 5286332 |

The above is not intended to constitute, nor should it be relied upon, to replace any professional advice. The above is based on our understanding of the two measures and the information available. No action should be taken without first consulting your tax advisor.

Download PDF