As you may know, the intention is to introduce a 7% turnover taxes on import of goods by entrepreneurs and non-entrepreneurs as per June 1, 2023. No further details are available at this moment.

Fictitious wage: Individuals that have a substantial interest (25% or more of the shares, either themselves, with their spouse or other relatives until the second degree) in the employer (so called director major shareholders, or in Dutch: “directeur groot aandeelhouders”) will fictitiously earn a wage that is at least the highest of:

- 75% of the wage of the most comparable employment;

- Wage of the highest paid employee in the company or a related entity;

- AWG 48,000.

If the substantial interest holder is the director of more than one related entity, the fictitious wage only applies once.

Counter evidence: if properly proven that a lower wage is applicable for similar function when no substantial interest is present, the lower wage may suffice.

For start-ups: the minimum wage is considered the fictitious wage. This is only applicable in the year of incorporation, and the subsequent three (3) years.

The fictitious wage does not count for (i) entities of which the profit is exempted (e.g. pension funds), (ii) entities which do not participate in the economic exchanges of Aruba and have an exemption from the Central Bank of Aruba, and (ii) non-resident individual directors or supervisory board members.

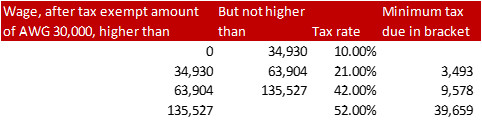

Wage tax table: The tax exempted amount will increase from AWG 28.861 to AWG 30,000. Furthermore, the income tax brackets and rates will change to the following:

The final changes

IPC regimes: Contrary to the prior announcements of the Minister of Finance, the transitional period of the old IPC regime (2% net corporate income tax) will be honored. The New IPC regime will be granted a same transitional period as the old one. All granted IPC status may be recognized until the last financial year that starts in 2025 (and ultimately may end in the year 2026 in the event of a book year not coinciding the calendar year).

Investment allowance: Investment allowance is maintained at 10%, but is as of 2023 limited again to investments in fixed assets purchase only from local suppliers.

Limitations in the deduction of expenses/payment:

- As per 2023 will apply to (i) payments to entities (current) but also (ii) individuals (new) and (iii) payments made to entities which shares are directly or indirectly, for at least 50% of the shares and voting rights, listed at a qualified stock exchange.

- Safe harbor from these limitations are:

- If payment is made to a non-related entity, whereby a relation is deemed present in case of an interest of 4% (before this used to be: 33.33% ) or more;

- If payment is included in the tax base of the recipient which is subject to a nominal tax rate of at least 15% (before this was more restrictive as effectively 15% tax paid by the recipient).

- The safe harbor rule where 75% of payment could be deducted if the recipient was subject to any rate (e.g. 1%) is abolished.

Depreciation of real estate: Tax deductibility of depreciation expenses on real estate is maximized on the difference between the book value and 50% of the registered value (in Dutch: “bodemwaarde”) or, in the absence thereof, 50% of the value as per article 6, paragraph 1, of the Ground Tax Act, being the market value.

Rate: Corporate income tax rate will be reduced per January 1, 2023 to 22% (before: 25%).

Personal Income Tax

The final changes

Pension insurers: Qualified pension insurers are solely entrepreneurial pension funds, insurance companies and (i) pension funds in another part of the Dutch Kingdom and/or (ii) other non-resident insurer or pension fund appointed by the Minister of Finance. As of 2023, a company of a substantial interest holder can no longer serve as a – self-administered - pension insurer.

Investment allowance: The investment allowance is maintained at 10%. We refer to the corporate income tax paragraph above.

Depreciation of real estate: We refer to the corporate income tax paragraph above.

Excessive borrowings by substantial interest holders from their companies: All borrowing exceeding

AWG 500,000 will be deemed excessive merely for tax purposes. This applies to entities in which the borrower or his/her spouse is a substantial interest holder. Any amount exceeding AWG 500,000 (nominal value) at the end of the calendar year (starting 2025) will be considered as disguised dividend and taxed against the flat rate of 25% income tax. In the subsequent year, the amount of AWG 500,000 is increased with each amount that was treated as a disguised dividend in the prior year to avoid double taxation.

Pension buy off: Pension buy offs after January 1, 2023 will be subject to the progressive income tax rates (as per the table mentioned under the paragraph wage tax). However, a transitional year is granted for pension buy offs meeting the criteria (we refer to our SmartNews pension buy off) until December 31, 2023, which buy offs are subject to a flat rate of 15%.

Separation of AOV levy for married couple: The AOV pension will be taxable at the individual receiving the AOV (before: attributed to the spouse with the highest personal income).

Income tax table: We refer to the wage tax table above.

Ground Tax

The final changes

Taxable base: Ground tax assessments will be raised annually (with a fixed value for five years, unless specific circumstances exist that have an effect on the value).

Exemptions:

- Abolishment of the exemption of ground tax for buildings or parts of buildings that have been unused or not rented during a period of at least six (6) consecutive months.

- Abolishment of the exemption of ground tax for the remaining year or the reduction in value in the event of full or partially destruction of buildings due to the unforeseen disasters.

Transfer Tax

The final changes

Inherited real estate or ships transfer are tax exempt: Upon passing away of an individual, no transfer tax will be due anymore on the transfer to the heirs of real estate and ships.

Transfer of economic ownership: Transferring economic ownership of real estate will be subject to transfer tax (3% up to AWG 250,000 and 6% on the amount exceeding AWG 250,000). An economic ownership already exists if the slightest change in value is attributable to someone else than the legal owner, except signing a purchase deed, purchase option or having a right to obtain the title. The seller of the economic ownership, if not by notarial deed, needs to notify the tax inspector within two weeks after obtaining the economic ownership of this event. If the notification is late, a penalty with a maximum of AWG 100,000, or, if the value of the property is higher than AWG 100,000, a maximum of 10% of that value.

Transfer of shares in real estate companies: Transferring shares of real estate companies will be subject to transfer tax (3% up to AWG 250,000 and 6% on the amount exceeding AWG 250,000). A real estate company is present if the companies’ assets consist for at least 30% of real estate located in Aruba (“ownership criterion”). Furthermore, the real estate should, in whole or primarily (in Dutch: “geheel of hoofdzakelijk”, i.e. 70% or more), contribute to generating, selling or exploiting the real estate (“function criterion”). Real estate includes the actual property, but also fictitious real estate such as shares in other real estate companies, economic ownership and other rights attached to the real estate or shares. The value of the shares equals at least the registered value of the Aruba properties of the real estate company. The seller of the shares, if not by notarial deed, needs to notify the tax inspector within two weeks after obtaining the economic ownership of this event. If the notification is late, a penalty with a maximum of AWG 100,000, or, if the value of the property is higher than AWG 100,000, a maximum penalty of 10% of that value can be imposed.

Subsequent transfers: If the economic ownership is purchased, and within twelve months the title of the real estate is also purchased by the same person (or vice versa), the value used for the first transfer can be deducted from the value to be used for the second transfer. The Ministerial Regulation for subsequent transfers within six months will be revoked.

Tourist levy

The final changes

Rate: Tourist levy will be increased with 3% from 9.5% to 12.5%.

Taxable base timeshare: Taxable base will be set on:

- Studio: AWG 197.26

- One-bedroom apartment: AWG 213.73

- Others: AWG 246.57

- All-inclusive: 50% of all-inclusive price with minimum of AWG 178.52

Allocation of funds: The allocation to the Aruba Tourism Authority is changed to 57%, 2.2% goes to the Tourism Product Enhancement Fund and the remainder is for the Government.

Agent: If a third party acts on behalf of an owner and collects the remuneration for the stay in a hotel, timeshare or other accommodation, this third party can become the withholding agent for the tourist levy and environmental levy.

Fiscal representative: For non-resident owners without a permanent establishment on Aruba, the owner or agent can appoint a fiscal representative on Aruba (via written declaration). The fiscal representative needs to notify the Tax Authorities of his/her appointment, and provide the written declaration). As of that moment, the fiscal representative can file the tax returns, and pay the taxes due, on behalf of the non-resident owner or agent. This also implies the fiscal representative is liable for the taxes (and penalties) of the non-resident owner or agent.

Dividend withholding tax

The final changes

Rate:

- Rate reduction of 10% to 5% is abolished for dividends paid to entities which shares are directly or indirectly, for at least 50% of the shares and voting rights, listed at a qualified stock exchange.

- IPC’s applying the new regime as of 2015 will, upon distributions out of the IPC profits until the last financial year starting in 2025, but prior to January 1, 2028, be able to apply the 0% dividend withholding tax rate.

- Abolishment of the 0% rate on dividends of companies with retained earnings derived from the tax holiday period. As per January 1, 2023, these companies can no longer apply the 0% rate provided upon the distribution of profits out of the tax holiday period.

General tax act

The final changes

Certain tax returns can, on instruction of the Director of Taxes, only be filed electronically.

- The annual wage tax summary (in Dutch: “verzamelloonstaat”) and third party summary (in Dutch: “verzamelstaat opgaaf derden”) need to be filed in March of every year.

Substantial interest holders and self-administered pensions

The proposed changes

- Self-administered pension plans are abolished as of January 1, 2023.

- The General Pension Act no longer applies to substantial interest holders.

Finally

The above is based on the final text of the law for the 2023 Tax Reform that was published on December 21, 2022 in AB 2022 no. 161.

How can BDO assist?

BDO Aruba has a dedicated team of professionals that is at your service. Please do not hesitate to contact us should you have any questions relating to the above or how the Beneficial Policy may be applied in your situation. You can reach BDO in Aruba at:

Office

L.G. Smith Boulevard 26 Oranjestad

Aruba

Tel: +297 5286336

E-mail

wolter.cari@bdoaruba.com snijders.frank@bdoaruba.com

statia.charitza@bdoaruba.com ponson.gabrielle@bdoaruba.com

kock.jean-marc@bdoaruba.com christiaans.verenna@bdoaruba.com