On November 29th 2022 the draft legislation for the 2023 Tax Reform was submitted to the Aruba Parliament. The proposed changes are aimed at increasing tax revenues on short term, but in our opinion without sufficiently considering the long-term effects of these measures on the Aruban economy. All changes are intended to enter into effect as per January 1, 2023, unless otherwise mentioned. Changes that are textual or have little practical impact will be disregarded.

Turnover taxes (Consisting of BBO, BAVP and BAZV)

The proposed changes

- Rate: Increase of the BBO with 1% from 1.5% to 2.5%; totaling 7% combined.

- Electronic & telecommunication services: Electronic services and telecommunication services (including transmitting, broadcasting or receipt of signals, images or sound) per cable, fiber, radiofrequency or other electromagnetic means will become taxable there where the recipient of the service lives or is situated;

- Small Entrepreneurs exemption: Maximum turnover to qualify for the small entrepreneurs exemption is lowered from AWG 84,000 (as per Beneficial Policy of November 6, 2020) to AWG 50,000 per year. Should the turnover during the year exceed this threshold, only the amount exceeding the threshold is subject to BBO/BAVP/BAZV.

- Fiscal representative: For non-resident entrepreneurs without a permanent establishment on Aruba, the entrepreneur can appoint a fiscal representative on Aruba (via written declaration). The fiscal representative needs to notify the Tax Authorities of his/her appointment, and provide the written declaration). As of that moment, the fiscal representative can file the turnover tax returns, and pay the turnover taxes due, on behalf of the non-resident entrepreneur. This also implies the fiscal representative is liable for the turnover taxes (and penalties) of the non-resident entrepreneur!

As you may know, the intention is to introduce a 7% turnover taxes on import of goods by entrepreneurs and non-entrepreneurs as per June 1, 2023. No further details are available at this moment.

Effect of the measure

- Rate: Increasing of BBO with 1% will, due to all-inclusive prices, require a change of the prices of all goods sold and services rendered. It will therefore result in an increase in costs of doing business of all residents and visitors of Aruba. Looking at the timing of the law, entrepreneurs are left with less than a month to properly adjust and prepare for the changes.

Technical observations

- Rate: No transitional regulation has been created for either commitments already entered into or goods already purchased. We hope the Tax Authorities will continue to apply the 2007 transitional regulation and re-instate this again.

- Taxable base: The turnover taxes included in the price still form part of the taxable base, implying that the grossed up rate is at least 7.52% (compared to current 6.38%).

- Combining levies: The BAZV (and BAVP) were supposed to be temporary measures, but have become “permanent” ones? Since the laws are effectively the same, it is not clear why the BAZV and BAVP have not been integrated into one BBO levy.

Wage Tax

The proposed changes

- Fictitious wage: Individuals that have a substantial interest (25% or more of the shares, either themselves, with their spouse or other relatives until the second degree) in the employer (so called director major shareholders, or in Dutch: “directeur groot aandeelhouders”) will fictitiously earn a wage that is at least the highest of:

- 75% of the wage of the most comparable employment;

- Wage of the highest paid employee in the company or a related entity;

- AWG 48,000.

If the substantial interest holder is the director of more than one related entity, the fictitious wage only applies once.

Counter evidence: if properly proven that a lower wage is applicable for similar function when no substantial interest is present, the lower wage may suffice.

For start-ups: the minimum wage is considered the fictitious wage. This is only applicable in the year of incorporation, and the subsequent three (3) years.

The fictitious wage does not count for (i) entities of which the profit is exempted (e.g. pension funds), (ii) entities which do not participate in the economic exchanges of Aruba and have an exemption from the Central Bank of Aruba, and (ii) non-resident individual directors or supervisory board members.

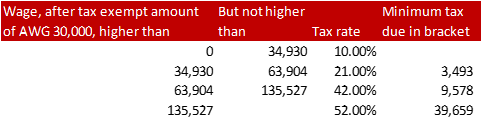

- Wage tax table: The tax exempted amount will increase from AWG 28.861 to AWG 30,000. Furthermore, the income tax brackets and rates will change to the following:

Effect of the measures

- Fictitious wage: As per 2023, substantial interest holders will need to have a fictitious wage, which will imply wage taxes will be due with a minimum of AWG 1,800. Furthermore, social security premiums will also be due on this fictitious wage, totaling an amount of AWG 12,480 (AWG 7,440 for AOV/AWW and AWG 5,040 for AZV).

- Rate: The brackets are significantly smaller, implying the higher bracket is reached sooner. Unfortunately, the opportunity was not taken to update the fringe benefit regulation since it is outdated (both in variety of allowances and amounts). That could have increased the net income of many employees as well.

Technical observations

- Fictitious wage:

- Does the 75% of the wage of the most comparable employment imply one needs to look within the (related group of) companies or also looking at the similar functions in the market? The latter would be impossible to do based on the limited information available on Aruba.

- The explanatory notes mention that for the application of a lower fictitious wage (for a start-up), filing of a petition at the Tax Authorities is required. However, the language of the law does not support this requirement.

- When applying a lower fictitious wage based on market conditions, we strongly recommend substantiating upfront (counter evidence file) to avoid potential deviations by the Tax Authorities.

- Unfortunately, there is no possibility to request a lower fictitious wage due to financial circumstances.

- If the spouse is a substantial interest holder without a wage, does the fictitious wage also apply?

- Based on the draft law, this fictitious wage also seems to apply to supervisory board members with a substantial interest, since they are (by fiction) employees.

- Does the wage only refer to base salary, or also include secondary benefits such as bonuses and other wage in kind remunerations received by the highest paid comparable employee?

Corporate Income Tax

The proposed changes

- IPC regimes: Contrary to the prior announcements of the Minister of Finance, the transitional period of the old IPC regime (2% net corporate income tax) will be honored. The New IPC regime will be granted a same transitional period as the old one. All granted IPC status may be recognized until the last financial year that starts in 2025 (and ultimately may end in the year 2026 in the event of a book year not coinciding the calendar year).

- Investment allowance: Investment allowance is maintained at 10%, but is as of 2023 limited again to investments in fixed assets purchase only from local suppliers.

- Limitations in the deduction of expenses/payment:

- As per 2023 will apply to (i) payments to entities (current) but also (ii) individuals (new) and (iii). payments made to entities which shares are directly or indirectly, for at least 50% of the shares and voting rights, listed at a qualified stock exchange.

- Safe harbor from this limitations are:

- If payment is made to a non-related entity, whereby a relation is deemed present in case of an interest of 5% (before this used to be: 33.33% ) or more;

- If payment is included in the tax base of the recipient which is subject to a nominal tax rate of at least 15% (before this was more restrictive as effectively 15% tax paid by the recipient).

- The safe harbor rule where 75% of payment could be deducted if the recipient was subject to any rate (e.g. 1%) is abolished.

- Depreciation of real estate: Tax deductibility of depreciation expenses on real estate is maximized on the difference between the book value and the registered value (in Dutch: “bodemwaarde”) or, in the absence thereof, the value as per article 6, paragraph 1, of the Ground Tax Act, being the market value.

- Rate: Corporate income tax rate will be reduced per January 1, 2023 to 22% (before: 25%).

Effect of the measures

- General: Expanding in corporate income tax base due to further limitation of deductibility of expenses will result in a higher increase of the effective tax burden for almost all entrepreneurs; despite the lowering of the general rate to 22%.

- IPC: Abolishment of IPC regime will have a major impact on high-end hotels and thus on Aruba’s economy.

- Investment allowance: Maintaining the 10 % but limiting its application only to local purchasing may not stimulate the economy and is not completely in line with the IMF Report. Impact of excluding the foreign purchases will further increase the effective tax burden of many entrepreneurs due to limited supply possibilities locally.

- Limitations in deduction of payments: Will apply much sooner and are much stricter, hence will also lead to a further increase of the effective tax burden of many entrepreneurs.

- Depreciation on real estate: Many entrepreneurs will no longer be able to, for tax purposes, depreciate on their buildings, which will not only effectively increase the tax base, but may also negatively affect cashflow for future remodeling, maintenance and new investments.

- Corporate income tax rate: The 3% reduction of the rate may not be sufficient to offset all proposed increase in the tax base.

Technical observations

- IPC: It is not clear why the IPC should be abolished. As per the end of the IPC regime, Aruba will have almost no fiscal incentives left to attract nor retain foreign investors. A limited 10% investment allowance only on local purchases is insufficient to keep or stimulate continued investments in for example hotels businesses.

- Investment allowance: Discussions may arise about moment of entering into a commitment or investment (before or after January 1, 2023). Furthermore, the own establishment costs (in Dutch: “voortbrengingskosten”, e.g. own employee costs related to the investment) are still excluded from the investment base. Since this exclusion seems based on an legal technicality or error, it is unfortunate this is again not redressed.

- Depreciation on real estate: There are many uncertainties on how the proposed changes should be interpreted. For example, if the book value is 100, and the registered value 80, in how many years should the remaining deprecation capacity of 20 be taken? In as many years as remain for the useful life, or in as many years as it would normally take to get to the book value equaling the (50 %) of the registered value?

- Corporate income tax rate: For companies with a financial year not equal to the calendar year, the profit subject to the old rate of 25% is pro-rata calculated based on the months in 2022; and against 22% applies for the profits earned as of January 1, 2023. But should the annual profit be split pro rate based on the months in each year, or by a P&L split taking into account the actual earned months’ profits?

Personal Income Tax

The proposed changes

- Pension insurers: Qualified pension insurers are solely entrepreneurial pension funds, insurance companies and (i) pension funds in another part of the Dutch Kingdom and/or (ii) other non-resident insurer or pension fund appointed by the Minister of Finance. As of 2023, a company of a substantial interest holder can no longer serve as a – self-administered - pension insurer.

- Investment allowance: The investment allowance maintained at 10%. We refer to the corporate income tax paragraph above.

- Depreciation of real estate: We refer to the corporate income tax paragraph above.

- Excessive borrowings by substantial interest holders from their companies: All borrowing exceeding

AWG. 500,000 will be deemed excessive for tax purposes. This applies to entities in which the borrower or his/her spouse is a substantial interest holder. Any amount exceeding AWG. 500,000 (nominal value) at the end of the calendar year (starting 2023) will be considered as disguised dividend and taxed at 25 % income tax. In the next year, the amount of AWG. 500,000 is increased with each amount that was treated as a disguised dividend in the past to avoid double taxation.

- Pension buy off: Pension buy offs after January 1, 2023 will be subject to the progressive income tax rates (as per the table below). However, a transitional year is granted for pension buy offs meeting the criteria (we refer to our SmartNews pension buy off) until December 31, 2023, which buy offs are subject to a flat rate of 15%.

- Separation of AOV levy for married couple: The AOV pension will be taxable at the individual receiving the AOV (before: attributed to the spouse with the highest personal income).

- Income tax table: We refer to the wage tax table above.

Effect of the measures

- Excessive borrowings: Resident and non-resident substantial interest holders are discouraged to borrow more than AWG. 500,000 from their own companies. That significantly limits the possibilities to use the excess cash of your own companies, and forces a substantial interest holder to obtain a loan from a third party or bank. Since the amount of AWG. 500,000 seems randomly chosen, it will disrupt the freedom of an entrepreneur to borrow for e.g. purchase of a new dwelling house. It is a missed opportunity that no exception is made for financing the dwelling house within the company at same market conditions set by third parties such as a bank.

Technical observations

- Excessive borrowings: It is not clear why loans invited by a substantial interest holder that relate to their own dwelling house and are secured by a mortgage should fall under this stipulation. In the Netherlands, an exception has been made for such loans. It is a missed opportunity, especially because in the Netherlands the amount is set on 700.000 euro.

- Depreciation on real estate: We refer to the corporate income tax paragraph.

Ground Tax

The proposed changes

- Taxable base: Ground tax assessments will be raised annually (with a fixed value for five years, unless specific circumstances exist that have an effect on the value).

- Exemptions:

- Abolishment of the exemption of ground tax for buildings or parts of buildings that have been unused or not rented during a period of at least six (6) consecutive months.

- Abolishment of the exemption of ground tax for the remaining year or the reduction in value in the event of full or partially destruction of buildings due to the unforeseen disasters.

Effect of the measures

- Tax payers will no longer have the possibility to claim a refund for ground tax in the event of continued vacancy of the building. The annual tax burden will therefore increase.

Technical observations

Transfer Tax

The proposed changes

- Inherited real estate or ships transfer are tax exempt: Upon passing away of an individual, no transfer tax will be due anymore on the transfer to the heirs of real estate and ships.

- Transfer of economic ownership: Transferring economic ownership of real estate will be subject to transfer tax (3% up to AWG 250,000 and 6% on the amount exceeding AWG 250,000). An economic ownership already exists if the slightest change in value is attributable to someone else than the legal owner, except signing a purchase deed, purchase option or having a right to obtain the title. The seller of the economic ownership, if not by notarial deed, needs to notify the tax inspector within two weeks after obtaining the economic ownership of this event. If the notification is late, a penalty with a maximum of AWG 100,000, or, if the value of the property is higher than AWG 100,000, a maximum of 10% of that value.

- Transfer of shares in real estate companies: Transferring shares of real estate companies will be subject to transfer tax (3% up to AWG 250,000 and 6% on the amount exceeding AWG 250,000). A real estate company is present if the companies’ assets consist, in whole or partially (“in Dutch: “geheel of gedeeltelijk”), of real estate located in Aruba (“ownership criterion”). Furthermore, the real estate should be in whole or primarily (in Dutch: “geheel of hoofdzakelijk”) contribute to generating, selling or exploiting the real estate (“function criterion”). Real estate includes the actual property, but also fictitious real estate such as shares in other real estate companies, economic ownership and other rights attached to the real estate or shares. The value of the shares equals at least the registered value of the Aruba properties of the real estate company. The seller of the shares, if not by notarial deed, needs to notify the tax inspector within two weeks after obtaining the economic ownership of this event. If the notification is late, a penalty with a maximum of AWG 100,000, or, if the value of the property is higher than AWG 100,000, a maximum of 10% of that value can be raised.

- Subsequent transfers: If the economic ownership is purchased, and within twelve months the title of the real estate is also purchased by the same person (or vice versa), the value used for the first transfer can be deducted from the value to be used for the second transfer. The Ministerial Regulation for subsequent transfers within six months will be revoked.

Effect of the measure

- Transfer of economic ownership or shares in real estate companies: Transfers of shares in real estate companies or transfers of economic ownership will as of 2023 be subject to transfer tax, which may create – if above functional condition is met - additional tax burden when performing internal reorganizations within a group entities.

Technical observations

- Real estate companies:

- The assets of a company should exists, in whole or in part, of real estate situated in Aruba (ownership criterion). There is no explanation of what “in part” implies: at least 50%, at least 75% or even 1% already triggers this taxation?

- Based on Dutch law, “in whole or primarily contributing to generating, selling or exploiting the real estate” (“function criterion”) implies that the real estate should be used for at least 70% within the own group. If not, the real estate is deemed to be aimed at trading or renting out (the so-called investment properties). Entities that use (almost) all of their real estate in their own business are therefore not covered by this criterion and fall outside of the levy of transfer tax. Think of a hotel, factory, a shop, a restaurant or a bank. The boundary between investment property and property for own use is not always very clear and could lead to controversy with the tax authorities.

- It is also not clear if the market value or the book values, either commercially or fiscally, should be used to determine if the ownership criterion is met (assuming it is not at e.g. 1%). It seems reasonable to assume that it will be the market value (with as a minimum the registered value), but some explanation or definition would have been preferred.

- Subsequent transfers: The existing Ministerial Regulation applies when, within six months after the first transfer, a real estate is transferred again. In that event, the value used for the first transfer can be deducted from the value to be used for the second transfer. This Ministerial Regulation therefore also applies to transfers from one party to the next. The new facility however only applies for transfers to oneself and is therefore much more limited. It would be preferable that the existing Ministerial Regulation is not withdrawn, but incorporated into the law as well.

- Notification: The purchaser of economic ownership or shares in a real estate company, if not by notarial deed, needs to notify the tax inspector within two weeks after the transfer of that transfer. The question is then what happens: will the tax inspector raise a transfer tax assessment? It seems likely that is the intention, implying that the tax inspector will have (at least) five years to do so? A tax payer could therefore be confronted with a transfer tax assessment years after the transfer took place.

Tourist Levy

The proposed change

- Rate: Tourist levy will be increased with 3% from 9.5% to 12.5%.

- Allocation of funds: The allocation to the Aruba Tourism Authority is changed to 57%, 2.2% goes to the Tourism Product Enhancement Fund and the remainder is for the Government.

- Agent: If a third party acts on behalf of an owner and collects the price for the stay in a hotel, timeshare or other accommodation, this third party will become the withholding agent for the tourist and environmental levy.

- Fiscal representative: For non-resident owners or agents without a permanent establishment on Aruba, the owner or agent can appoint a fiscal representative on Aruba (via written declaration). The fiscal representative needs to notify the Tax Authorities of his/her appointment, and provide the written declaration). As of that moment, the fiscal representative can file the tax returns, and pay the taxes due, on behalf of the non-resident owner or agent. This also implies the fiscal representative is liable for the taxes (and penalties) of the non-resident owner or agent.

Effect of the measure

- The tourist levy will now partially be used for general purposes of the Government of Aruba and no longer allocated to the marketing & promotion of Aruba. This may have a long-term negative impact on tourism due to lower marketing budget and eventually also on the economy of Aruba in general.

Technical observation

- Agent: Based on the current wordings of the law, any third party/ intermediary collecting the price for a stay at a hotel, timeshare or other accommodation will become liable for the tourist levy. This is in our opinion not the intention of the law and would create significant practical issues (both for the agent and the tax authorities).

Dividend withholding tax

The proposed changes

- Rate:

- Rate reduction of 10% to 5% is abolished for dividends paid to entities which shares are directly or indirectly, for at least 50% of the shares and voting rights, listed at a qualified stock exchange.

- IPC’s applying the new regime as of 2015 will, upon distributions out of the IPC profits until the last financial year starting in 2025, but prior to January 1, 2028, be able to apply the 0% dividend withholding tax rate.

- Abolishment of the 0% rate on dividends of companies with retained earnings derived from the tax holiday period. As per January 1, 2023, these companies can no longer apply the 0% rate provided upon the distribution of profits out of the tax holiday period.

Effect of the measures

- IPC’s: Increase in effective tax rate of new IPC’s (beside the increase in corporate income tax rate) with at least 5% after transitional regulation ends.

- Indirectly stock exchange listed companies: For indirectly stock exchange listed companies, a similar increase may occur depending on their shareholders’ structure.

- Tax holiday profits: Increase in effective tax rate with 5% up to 10 % for companies with tax holiday retained earnings that have not yet been distributed.

Technical observations

General tax act

The proposed change

- Certain tax returns can, on instruction of the Director of Taxes, only be filed electronically.

Effect of the measure

- Administrative burden and downtime (standing in line) should decrease.

Technical observations

- It is assumed this will relate to payroll taxes and turnover taxes but has not been defined further. Although it is to be applauded that online returns can be filed, it can be questioned if alternative can be offered to especially, smaller employers or older entrepreneurs not in the possession of proper equipment and infrastructure to do this and therefore may still prefer a paper return.

Substantial interest holders and self-administered pensions

The proposed changes

- Self-administered pension plans are abolished as of January 1, 2023.

- The General Pension Act no longer applies to substantial interest holders.

Effect of the measures

- Increase in effective tax rate of all entrepreneurs with self-administered pension plans, since contribution to pensions will likely be lower as of 2023, since the premiums will lead to a direct cash outflow.

Technical observations

- Complete abolishment is insufficiently substantiated.

- Although pensions are indeed technically complex, actuarial calculations support most of the pension provisions.

- Should the deduction of pension premiums for self-administered pension plans be deemed too high, other measures that mitigate the deductibility of premiums but still safeguards an entrepreneurs’ pension would have been not only simple to introduce but also fair. Especially, when a fictitious wage is introduced this would merit also a minimum required pension, which is more than the AOV payment.

- Because the substantial interest holder is excluded from the General Pension Act, the substantial interest holder has two choices.

- Continue to build up a pension in the own company. Because the own company is not a qualified insurer, the employee premiums for a pension are no longer tax deductible, but the payments derived from these contributions are tax exempt. Premiums contributions paid by the employer will subsequently be taxable, but the payments will also be exempted.

- Closing a personal insurance agreement at a professional insurer. However, employee’s contribution (premium) may only be tax deductible (and the employer contribution is only tax exempted) if pension granted meets the fiscal conditions set and are granted via a labor agreement.

- Otherwise, premiums for life insurance products will be only deductible up to AWG 10,000 per year.

- Since pension insurers are generally no longer willing to insure defined benefit plans, with this measure only civil servants are entitled to defined benefit plans. Besides the fact that this type of pension incurs a significant expense for the Government of Aruba, it further contributes to the market distortions between the public and private sector when looking at secondary benefits; discouraging talented individuals starting a business since they need to comply with the fictitious wages requirement after the start-up phase (and thus pay at least AWG. AWG. 12,480 in wage tax and social security premiums on the minimum fictitious salary) but without any beneficial pension facility left available for their old age.

Finally

The above is based on the draft text of the law sent to Parliament on November 29, 2022. The final text of the law may be subject to change.

How can BDO assist?

BDO Aruba has a dedicated team of professionals that is at your service. Please do not hesitate to contact us should you have any questions relating to the above or how the Beneficial Policy may be applied in your situation. You can reach BDO in Aruba at:

Office

L.G. Smith Boulevard 26 Oranjestad

Aruba

Tel: +297 5286336

E-mail:

wolter.cari@bdoaruba.com snijders.frank@bdoaruba.com

statia.charitza@bdoaruba.com ponson.gabrielle@bdoaruba.com

kock.jean-marc@bdoaruba.com christiaans.verenna@bdoaruba.com